California’s Groundbreaking Legal Mandate for Women Serving on Boards of Directors of Publicly Traded Companies Goes Into Effect in 2019

The end of 2019 marks California’s deadline for publicly traded companies with headquarters or “principal executive offices” in the state to comply with a new law requiring women have seats on their board of directors.

The progressive bill, named SB-826 and signed into law in Q4 2018 by then-Governor Jerry Brown, is the most dramatic evidence yet that state governments not only take diversity seriously, but that economic well-being is at stake, too. After all, California’s $2.7 trillion GDP is the 5th largest economy in the world, larger than the entirety of the U.K., an accomplishment of which California is both proud and protective. The law, a first of its kind, is out of the purview of the SEC.

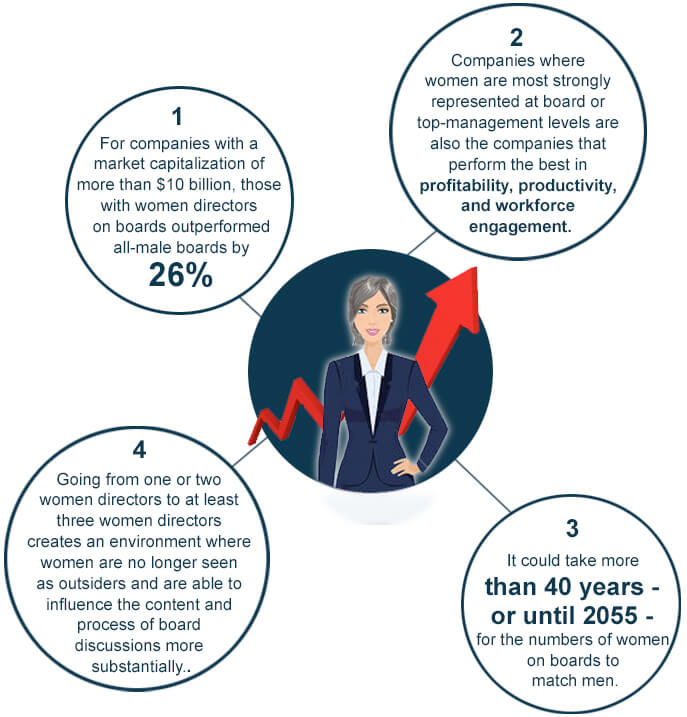

In medical terms, what diagnosis is California fixing? In short, a gender imbalance ailment hitting its wallet. A growing mountain of research led to an evidence-based approach by the State Legislature, taking into consideration a decade worth of studies from esteemed scientists, economists and consultants from around the world. The bottom line? By not having women on boards of directors, California-based business profits and job growth projections, along with the state’s world-class GDP, aren’t actually reaching their collective economic potential.

AA

Combined with the socio-professional benefits of workplace equality, the economic data and conclusions about women serving on boards proved too compelling for California to ignore.

Reference:

1. Credit Suisse Research Institute 2014, ‘The CS Gender 3000: Women in Senior Management’ Higher Returns, Higher Valuations and Higher Payout Ratios.

https://www.credit-suisse.com/corporate/en/articles/media-releases/42376-201409.html

2. McKinsey & Company 2016, ‘Women Matter: Reinventing the Workplace to Unlock the Potential of Gender Diversity’ https://www.mckinsey.com/~/media/mckinsey/featured%20insights/women%20matter/reinventing%20the%20workplace%20for%20greater%20gender%20diversity/women-matter-2016-reinventing-the-workplace-to-unlock-the-potential-of-gender-diversity.ashx)

3. United States Government Accountability Office 2015

4. Journal of Business Ethics 2011 ‘Women Directors on Corporate Boards: From Tokenism to Critical Mass’ by Mariateresa Torchia, Andrea Calabró, and Morten Huse

http://www.academia.edu/15826037/Women_Directors_on_Corporate_Boards_From_Tokenism_to_Critical_Mass

The new law has specific guidelines for adherence and stiff penalties for non-compliance. For companies that have 6 board directors, there must be 3 females; if the board is comprised of 5 people, then 2 directors must be female; while smaller boards of 4 or fewer directors must contain at least 1 female. If a company isn’t in compliance by early 2020, it will be fined $100,000 for the first violation, then $300,000 for the second violation.

But how will the legislation affect California-based life sciences companies?

Included in the Golden State’s $2.7 trillion GDP is at least $169 billion in life sciences revenue, generated by 3,249 companies employing 299,000 people, but in totality supporting 919,000 direct, indirect and induced jobs. These companies do important scientific work in clusters in San Diego, Orange County, Los Angeles, Silicon Valley, and San Francisco, professionally affecting nearly 1 in 39 Californians.

While the data isn’t immediately clear from the California Life Sciences Association how many of its 3,249 member companies are publicly traded or have principal executive offices in the state, what is clear is that life sciences investors, both institutional and individual, are eager to recoup not only investments, but R&D dollars consumed by research, trials, and years-long regulatory body and public policy timelines. The core research which prompted SB-826 suggests that life sciences investments placed in California could yield faster returns by virtue of placing more women on more boards, which will drive more profits, productivity, performance, and larger market capitalizations.

The question remains as to exactly how quickly these publicly traded companies can lockstep into California compliance by identifying female board candidates and announcing placements. Boardroom diversity advocacy organizations like Athena Alliance, run by entrepreneur Coco Brown, help place women on boards through networking, relationship building, and sheer will.

But more typically, these publicly held organizations will engage professionals at executive search firms to identify and vet accomplished women to help accelerate these board placements, relying on their vast networks of smart, qualified females who are not necessarily hailing from identical industries. In life sciences, precision medicine, personalized medicine, telemedicine, wearables, and direct-to-consumer business models are changing the complexion of boards to include exceptional female executives from consumer packaged goods, big technology, marketing and services firms.

The days of tokenism in California are clearly over. Women aren’t just good for business, they’re great for business.